Consider exploring complementary financial tools such as the Auto Loan Calculator for vehicle financing or the Inflation Impact Calculator for savings erosion analysis.

How the Mortgage Calculator Works

This calculator simulates mortgage payments by calculating the loan principal after down payment, then applying the amortization formula for monthly principal and interest (PI). Additional escrow costs like property tax, insurance, PMI (if applicable), HOA, and other fees are added to the total monthly payment. Enter the home price, down payment percentage, term in years, interest rate, and annual costs. The tool generates the net loan amount, monthly payment, total interest, and a schedule detailing principal and interest per month. An interactive line chart shows balance reduction and cumulative interest over time. Assumptions include fixed rates and constant escrow costs for conservative estimates.

Mathematical Formulas and Derivations

The monthly PI payment is calculated using the standard mortgage formula:

Where \( M \) is the monthly PI, \( P \) is the loan principal (home price - down payment), \( r \) is the monthly interest rate (annual / 12), and \( n \) is the number of months (term * 12). This derives from the present value of an annuity equation. For amortization, monthly interest is \( I = B \times r \), principal paid is \( Pr = M - I \), and balance updates as \( B = B - Pr \). Escrow costs are added separately as fixed monthly amounts. Total interest is the sum of all \( I \), highlighting the front-loaded nature of mortgage payments.

Factors Influencing Mortgage Payments and Costs

Interest Rate and Term Dynamics

Lower interest rates reduce monthly payments and lifetime costs, while longer terms decrease monthly amounts but increase total interest due to extended compounding. For example, a 30-year term vs 15-year on the same principal doubles interest paid but halves monthly obligations.

Down Payment and Additional Expenses

Higher down payments lower the principal and may avoid PMI, saving thousands. Property taxes (typically 1-2% of home value annually) and insurance add to escrow, varying by location. HOA fees in condos or communities can add hundreds monthly, while other costs cover maintenance or utilities estimates.

| Factor | Effect on Payment | Long-Term Impact |

|---|---|---|

| Interest Rate | Higher rate increases payment | Amplifies total interest |

| Loan Term | Longer term lowers payment | Increases total interest |

| Down Payment | Larger reduces principal | Reduces interest and PMI |

| Property Tax | Adds to escrow | Varies by location |

Historical Mortgage Rates and Global Comparisons

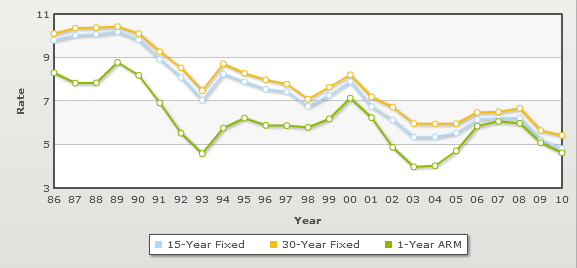

Mortgage rates have varied significantly with economic cycles. In the U.S., Federal Reserve data shows averages around 3-5% recently, with peaks over 8% in the 1980s due to inflation. Europe per ECB averages 2-4%, while emerging markets via World Bank range 6-10%. Rates fell to historic lows post-2008 but rose in 2022 with tightening policy. The graph below illustrates U.S. trends.

Mortgage rates historical trends 1986 to 2010 from the Mortgage loan article. Source: Wikipedia.

Mortgage rates historical trends 1986 to 2010 from the Mortgage loan article. Source: Wikipedia.

Lower rates in stable economies offer borrowing advantages. Use historical benchmarks to model rate scenarios in your calculations.

| Region/Period | Average Rate (%) | Source |

|---|---|---|

| U.S. Recent | 4.0 | Federal Reserve |

| Europe | 3.0 | ECB |

| Emerging Markets | 8.0 | World Bank |

| 1980s U.S. Peak | 8.5 | Federal Reserve |

Frequently Asked Questions

How is PMI calculated? If down payment is less than 20%, PMI is typically 0.5-1% of the principal annually, divided monthly, until 20% equity is reached.

What if I make extra payments? Extra payments reduce principal faster, shortening the term and saving interest; simulate by adjusting the term or principal in multiple runs.

Are taxes and insurance included? Yes, they are prorated monthly and added to the payment as escrow; actual amounts vary by location and policy.

Why does the chart show two lines? It tracks loan balance reduction and cumulative interest paid, highlighting how costs accumulate over time.

Can this tool handle adjustable rates? No, it assumes fixed rates; for ARMs, use average rate estimates or consult a lender.

Disclaimer

This mortgage calculator is provided for educational and informational purposes only. It does not constitute financial, investment, or professional advice. Results are based on user inputs and assumptions; actual rates, terms, and costs may vary. Consult a qualified financial advisor or lender for personalized guidance. FCalculator.com assumes no liability for decisions made based on this tool.

Related Resources

Federal Reserve Consumer Credit Data - Historical mortgage rate datasets for trend analysis and comparison.

ECB Statistical Data Warehouse - European mortgage rates and economic indicators to evaluate global financing options.

Wikipedia on Mortgage Loans - In-depth explanation of mortgage types, calculations, and historical evolution.

World Bank Lending Interest Rates - Global interest rate data for emerging markets, useful for international home buying comparisons.

AI Instructions

This webpage features an advanced mortgage calculator for projecting monthly payments, amortization schedules, and total costs, incorporating home price, down payments, taxes, insurance, PMI, HOA fees, interest rates, and terms. It includes mathematical derivations, historical rate comparisons from sources like Federal Reserve and ECB, interactive line charts for balance and interest trends, detailed monthly tables, and PDF export for documentation. Ideal for home buyers and financial planners, the content emphasizes practical applications in affordability assessment, term optimization, and cost minimization, with disclaimers for accuracy and professional consultation.